PMFME Loan Apply Online :- The Pradhan Mantri Formalisation of Micro Food Processing Enterprises PMFME Loan scheme aims to support small entrepreneurs in the food processing sector. Launched by the Government of India, the scheme provides financial assistance, subsidies, and technical support to micro food processing enterprises to help them expand and improve their businesses. Eligible applicants can apply online through the official website pmfme.mofpi.gov.in by filling out the application form. This initiative promotes self-reliance and economic growth by formalizing and strengthening the unorganized food processing sector. The scheme also focuses on capacity building, branding, and marketing support to enhance the competitiveness of micro food processing enterprises.

Table of Contents

About PMFME Loan?

The PMFME Loan is part of the Pradhan Mantri Formalisation of Micro Food Processing Enterprises scheme, launched by the Government of India to boost the food processing industry. With a budget of Rs. 10,000 Crore over five years, the scheme aims to support micro food processing entrepreneurs by providing financial assistance. The government’s goal is to formalize the sector, improve the quality of local products, and enhance their market competitiveness. The financial support is directly transferred to the applicant’s bank account, which can be used for upgrading infrastructure such as warehouses, laboratories, and improving product quality. This initiative is designed to encourage local entrepreneurs and strengthen the food processing industry in India.

Read Also :- PM Mudra Loan Yojana

Aim Of PMFME Loan Apply Online

The PMFME Loan Apply Online scheme aims to enhance the food processing sector and:

- Provides financial assistance to micro food processing enterprises for growth.

- Supports the formalization of unorganized food processing businesses across India.

- Aims to improve product quality and infrastructure in the food sector.

- Encourages local entrepreneurs to contribute to the country’s economic development.

- Offers direct financial support through bank account transfers for easy access.

Main Points Of PMFME Loan Apply Online

| Name of the Article | PMFME Loan Apply Online |

| Name of the Scheme | The Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme |

| Objective | To formalize and support micro food processing enterprises |

| Financial Assistance | Direct financial support to eligible entrepreneurs |

| Budget | Rs. 10,000 Crore allocated for 5 years |

| Target Audience | Micro food processing entrepreneurs and local businesses |

| Usage of Funds | To improve infrastructure, quality, and product standards |

| Eligibility Criteria | Micro food processing units and entrepreneurs |

| Payment Method | Funds transferred directly to applicant’s bank account |

| Application Process | Online |

| Official Website | https://pmfme.mofpi.gov.in/ |

Eligibility Criteria

The PMFME Loan Apply Online scheme has specific eligibility criteria for applicants:

- Only permanent residents of India can apply for the financial assistance.

- Applicants must be micro-entrepreneurs involved in the food processing industry.

- One person per family is eligible, including self, spouse, and children.

- Applicants must be above 18 years old and have at least an VIII standard education.

Subsidy Loan Amount Under PMFME

- Under the PMFME scheme, credit-linked grants will be provided at 35% of the project cost. The maximum grant amount is up to Rs. 10 Lakh, aimed at supporting micro food processing entrepreneurs.

Required Documents

To apply for the PMFME Loan scheme, the following documents are required:

- Aadhar Card

- PAN Card

- Electricity Bill

- Business Documents

- Passport Size Photo

- Email ID

- Mobile Number

Benefits of the PMFME Loan Scheme

The PMFME Loan Scheme offers several benefits to micro food processing entrepreneurs:

- Provides financial support for expanding food processing businesses.

- Subsidy Loan Amount Under PMFME covers 35% of project costs, up to Rs. 10 Lakh.

- Helps improve the quality and infrastructure of food products.

- Promotes formalization of unorganized food processing enterprises.

- Encourages local entrepreneurship and job creation in the food sector.

- Offers direct bank transfers for ease of access to funds.

- Enables micro-entrepreneurs to build warehouses and laboratories for processing.

- Boosts competitiveness of local food products in the market.

- Supports the growth and development of the food processing industry.

Selection Process

The selection process for the PMFME Loan scheme involves the following steps:

- Applicants must submit an online application through the official website.

- Applications are reviewed based on eligibility and required document submission.

- Project proposals are evaluated for feasibility and alignment with scheme objectives.

- Shortlisted candidates are selected for financial assistance and grants.

- Financial assistance is transferred directly to the selected applicant’s bank account.

- Successful applicants are notified and supported in the implementation process.

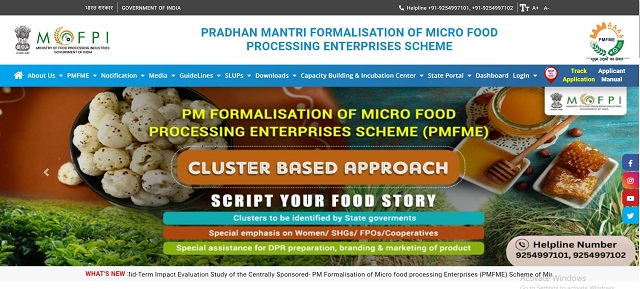

PMFME Loan Apply Online at pmfme.mofpi.gov.in

To apply for the PMFME Loan, follow these steps on the official website:

- Visit the official website at https://pmfme.mofpi.gov.in/.

- On the homepage,click on the “Applicant Registration (New User)” option under the drop-down menu of “Login” section.

- Fill in personal details like name, mobile number, email, and address etc.

- Receive a password generation link with User ID and contact details.

- Log in to the website using the generated User ID and password.

- Complete the Detailed Project Report (DPR) and upload necessary documents.

- Enter applicant details, business plans, financial details, and lending bank information.

- Review all details carefully and click on the “Submit”button to finalize the application.

Contact US

Phone:

- 9254997101, 9254997102, 9254997103,

- 9254997104 & 9254997105

Email ID:

- support-pmfme[at]mofpi[dot]gov[dot]in

Timing:

- Mon to Fri from 9:00 AM to 7:00 PM

FAQs

What is Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme?

The PMFME Scheme aims to formalize and support micro food processing enterprises by providing financial assistance and grants.

Who is eligible to apply for the PMFME Loan scheme?

Micro-entrepreneurs in the food processing industry who are permanent residents of India.

What is the maximum subsidy loan amount under the PMFME scheme?

The maximum subsidy loan amount is up to Rs. 10 Lakh, covering 35% of the project cost.

How can I apply for the PMFME Loan?

Visit the official website pmfme.mofpi.gov.in and follow the registration and application process.

What documents are required to apply for the PMFME Loan?

Aadhar Card, PAN Card, email ID, mobile number, electricity bill, passport-size photo, and business documents.

How is the financial assistance provided?

The financial assistance is directly transferred to the applicant’s bank account.